By Steve Pawlyk

Published July 1, 2025

TLDR:

The Varsity Pro Cheer League launches in 2026 with four teams, part-time five-figure salaries, and a January-March season that creates both unprecedented opportunities and existential threats for gym owners. After $126 million in antitrust settlements, Varsity Spirit is betting that professionalizing cheerleading will rehabilitate its image while further consolidating its control over the sport—a move that forces every competitive gym to reconsider its business model, athlete development strategy, and relationship with the industry’s dominant player.

For gym owners and coaches, this isn’t just another competition format. It’s a fundamental restructuring of how elite cheerleading works in America. The league’s structure—with Varsity owning all teams, controlling all athlete contracts, and selecting only established mega-gyms as partners—signals a new era where professional pathways exist but remain firmly within Varsity’s ecosystem. Whether you view this as the sport’s natural evolution or another monopolistic power grab, most likely depends on whether your gym is on the inside or outside of Varsity’s inner circle.

The league’s blueprint reveals calculated control

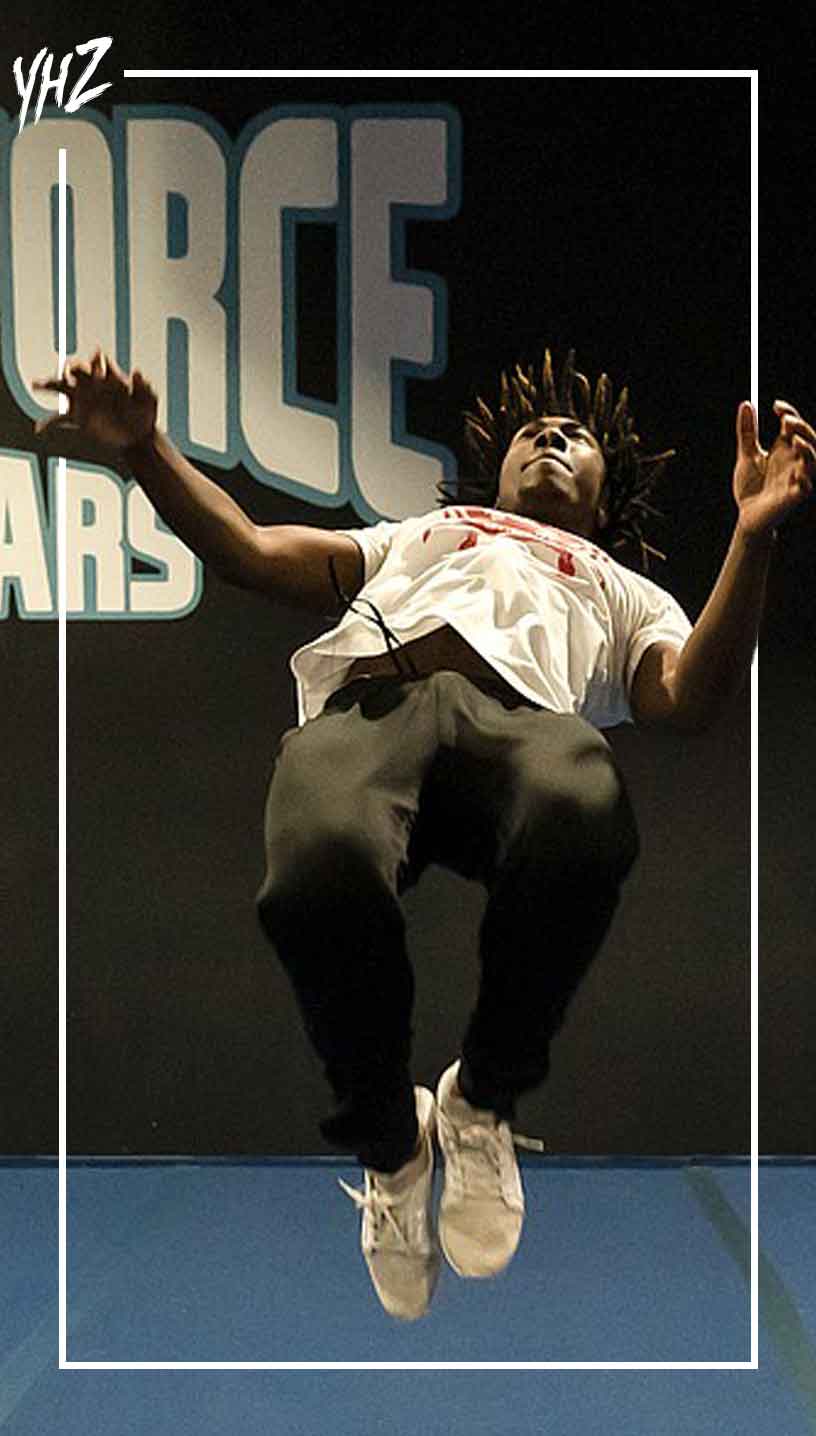

The Pro Cheer League’s structure demonstrates Varsity’s methodical approach to maintaining market dominance while appearing to advance the sport. Four founding teams in Atlanta, Dallas, Miami, and San Diego will each field 30 athletes, creating just 120 professional positions nationwide. These teams will train at Varsity’s chosen facilities: Stingray Allstars, Cheer Athletics, Top Gun All Stars, and California All Stars—notably all gyms with deep Varsity relationships and significant market power.

Athletes earn “five-figure” annual salaries as part-time Varsity Spirit employees, with additional compensation including travel, lodging, uniforms, and performance bonuses. The season runs January through March 2026, featuring five events in Indianapolis, Atlanta, Houston, Anaheim, and Nashville. Competition format includes head-to-head skills battles and traditional team routines, designed for television appeal.

What’s revealing isn’t just what Varsity included but what they carefully controlled. All teams remain wholly owned by Varsity Spirit, eliminating any pretense of independent competition. Athletes can pursue individual sponsorships only “with league approval.” Teams practice at pre-selected facilities, ensuring only certain gyms benefit from professional presence. This isn’t professional cheerleading emerging organically—it’s Varsity creating a closed system where they control every aspect from tryouts to championships.

Industry reactions expose deep divisions

The cheerleading community’s response reveals a sport wrestling with its identity and independence. While USA Cheer’s executive director Lauri Harris called it an “exciting development,” and partner gym owners expressed enthusiasm, deeper analysis shows significant concerns about Varsity’s motivations and methods.

Dan Cotton of the Cheer Biz Podcast captured the nuanced reaction: while showing “excitement about the professional step forward,” he expressed “serious concerns about gym affiliations, athlete eligibility, and long-term vision.” This balanced view reflects many industry professionals who want athlete opportunities but worry about implementation.

More pointed criticism emerged from business analysts and legal observers. Front Office Sports positioned the league as Varsity’s attempt to “turn the page after a litany of legal headaches” following their recent settlements. Sportico noted the timing “comes as Varsity works to rehabilitate its corporate image in the wake of antitrust and sex-abuse lawsuits.” The fierceboard community, representing grassroots gym owners and coaches, discussed Varsity’s “unfair monopoly” and debated boycott strategies.

Matt Stoller’s antitrust newsletter provided historical context, noting that Varsity founder Jeff Webb “testified in court that the competitions exist solely for the promotion of his cheerleading supply business.” This admission undermines claims that the professional league primarily serves athlete interests rather than corporate strategy.

Your gym faces an athlete retention crisis

For non-partner gyms, the most immediate threat is talent drain. Research from other youth sports shows that 90% athlete retention is considered excellent, but losing your top 18+ athletes to professional teams could devastate this metric. The psychological impact extends beyond numbers—younger athletes lose role models, team dynamics shift, and your gym’s competitive edge dulls.

The financial mathematics are brutal. If you lose 20% of your elite athletes, expect 12-15% revenue decrease in the first year before accounting for reduced competition success, lower enrollment from diminished reputation, and increased recruiting costs. These aren’t just your highest-paying clients; they’re your advertisement for excellence, your coaching assistants, and your culture carriers.

Consider how travel hockey destroyed community programs. Local rinks that once developed NHL players now struggle to field house leagues because elite players migrated to specialized facilities. Little League participation dropped 20% from its 2000s peak as travel baseball captured serious players. Cheerleading won’t be different—except Varsity controls both the amateur and professional pathways, giving them unprecedented power to direct athlete flow.

Smart gyms will implement “alumni ambassador” programs immediately, creating formal relationships with departing athletes. Develop “hybrid training” programs serving both all-star and professional-track athletes. Most critically, begin recruiting younger athletes more aggressively, knowing your development timeline just compressed.

Schedule conflicts create operational nightmares

The Pro League’s January-March season seems strategically timed to minimize conflicts with Worlds in April, but this surface-level analysis misses the deeper disruption. November through March represents peak training season for all-star teams preparing for their championship run. Your best athletes—and possibly coaches—will have divided attention during the most critical preparation period.

Varsity claims athletes can continue with all-star teams “during the inaugural season,” but anyone who’s managed elite athletes knows this promise rings hollow.

How does an athlete maintain peak performance for both professional competitions and Worlds preparation? When professional team practice conflicts with all-star training, which takes priority? These aren’t hypothetical concerns—they’re scheduling nightmares that will fracture teams and force impossible choices.

The coaching impact may prove even more disruptive. If your top coaches get pulled toward professional teams—either as athletes or support staff—your entire program suffers. The industry already faces a qualified coaching shortage, and this league will exacerbate the problem by creating competing demands for limited talent.

Forward-thinking gyms should negotiate coaching arrangements now, before the professional teams lock in their staff. Create clear policies about conflict resolution and priority setting. Consider developing specialized tracks where some teams focus on traditional all-star competition while others prepare athletes for professional tryouts. The gyms that acknowledge this fundamental split early will adapt most successfully.

Financial opportunities exist for strategic gyms

While challenges dominate, smart gym owners can find significant opportunities in this restructuring. The four partner gyms—Stingray, Cheer Athletics, Top Gun, and California All Stars—gained enormous advantages through facility partnerships, but they’re not the only potential winners.

New revenue streams emerge for gyms positioned correctly. Professional athlete training camps and clinics command premium pricing. “Pro-prep” programs targeting ambitious 16-17 year olds can charge 30-50% above standard tuition. Equipment partnerships, merchandise sales, and content creation opportunities multiply when you’re associated with professional development.

International athlete recruitment presents an underexplored opportunity. With cheerleading’s Olympic recognition and growing global participation, 7.5 million athletes across 119 countries represent a vast market. American gyms offering professional pathway programs can attract international talent willing to pay premium prices for elite training.

The youth sports economy generates $15-28 billion annually, with families spending average of $883 per child. Parents already demonstrating willingness to invest heavily will pay more for programs with clear professional pathways. Position your gym as the regional center for professional development—even without direct league partnership—and capture this premium market segment.

Consider how gymnastics gyms evolved when elite pathways clarified. Facilities specializing in Olympic-track development command prices 3-4x higher than recreational programs. Parents pay willingly because the pathway is clear, the coaching is elite, and the possibilities seem tangible. The Pro Cheer League creates similar dynamics in cheerleading.

Partnership strategies beyond the chosen four

Varsity selected four mega-gyms as inaugural partners, but expansion is inevitable. Position your gym now for future partnership opportunities by demonstrating value to the professional ecosystem. This requires strategic thinking beyond hoping for selection.

Develop formal relationships with current partner gyms. Create athlete exchange programs, coaching education partnerships, or specialized training camps that benefit both facilities. When expansion comes, Varsity will look for gyms already integrated into their professional network. Building these relationships costs little but positions you favorably for future opportunities.

Geographic strategy matters enormously. The inaugural teams represent major metropolitan markets, but numerous large cities remain unclaimed. If you’re in Chicago, Philadelphia, Phoenix, or Seattle, begin positioning as the obvious expansion choice. This means upgrading facilities, developing elite coaching staff, and demonstrating market dominance that makes you indispensable.

Media and content creation capabilities increasingly influence partnership decisions. Gyms with professional video production, strong social media presence, and proven ability to generate engaging content offer value beyond traditional metrics. Invest in these capabilities now—they’re table stakes for professional sports involvement.

Most importantly, maintain flexibility in your Varsity relationship. While partnership offers opportunities, it also creates dependencies. The most successful gyms will develop multiple revenue streams and maintain some independence, ensuring they’re not entirely beholden to Varsity’s strategic decisions.

Monopoly concerns shape industry dynamics

Understanding Varsity’s business model is crucial for navigating this new landscape. KKR’s $4.75 billion acquisition in August 2024 provides the capital backing this professional expansion. With Varsity generating $400+ million in annual EBITDA, they possess resources no competitor can match.

The antitrust context cannot be ignored. Varsity paid $82.5 million in 2024 and $43.5 million in 2023 settling monopoly allegations. They still face ongoing litigation in Texas. Launching a professional league while fighting antitrust claims seems audacious—or desperate, depending on your perspective.

Varsity’s vertical integration creates unique challenges for independent gyms. They control competitions, uniforms, governing bodies (through relationships with USA Cheer and USASF), and now professional opportunities. Every aspect of an athlete’s journey can occur within Varsity’s ecosystem, making it increasingly difficult for gyms to operate independently.

This control extends to seemingly minor details with major implications. Athletes need league approval for individual sponsorships. Teams use Varsity-mandated equipment. Media rights negotiations happen through Varsity’s existing ESPN relationship. Each element reinforces their market control while appearing to advance the sport.

For gym owners, this monopolistic structure presents a devil’s bargain. Partnering with Varsity provides access to resources and opportunities impossible to achieve independently. But it also means accepting their rules, their pricing, and their strategic decisions. The cheerleading industry increasingly resembles a company town where Varsity owns the store, the bank, and now the factory.

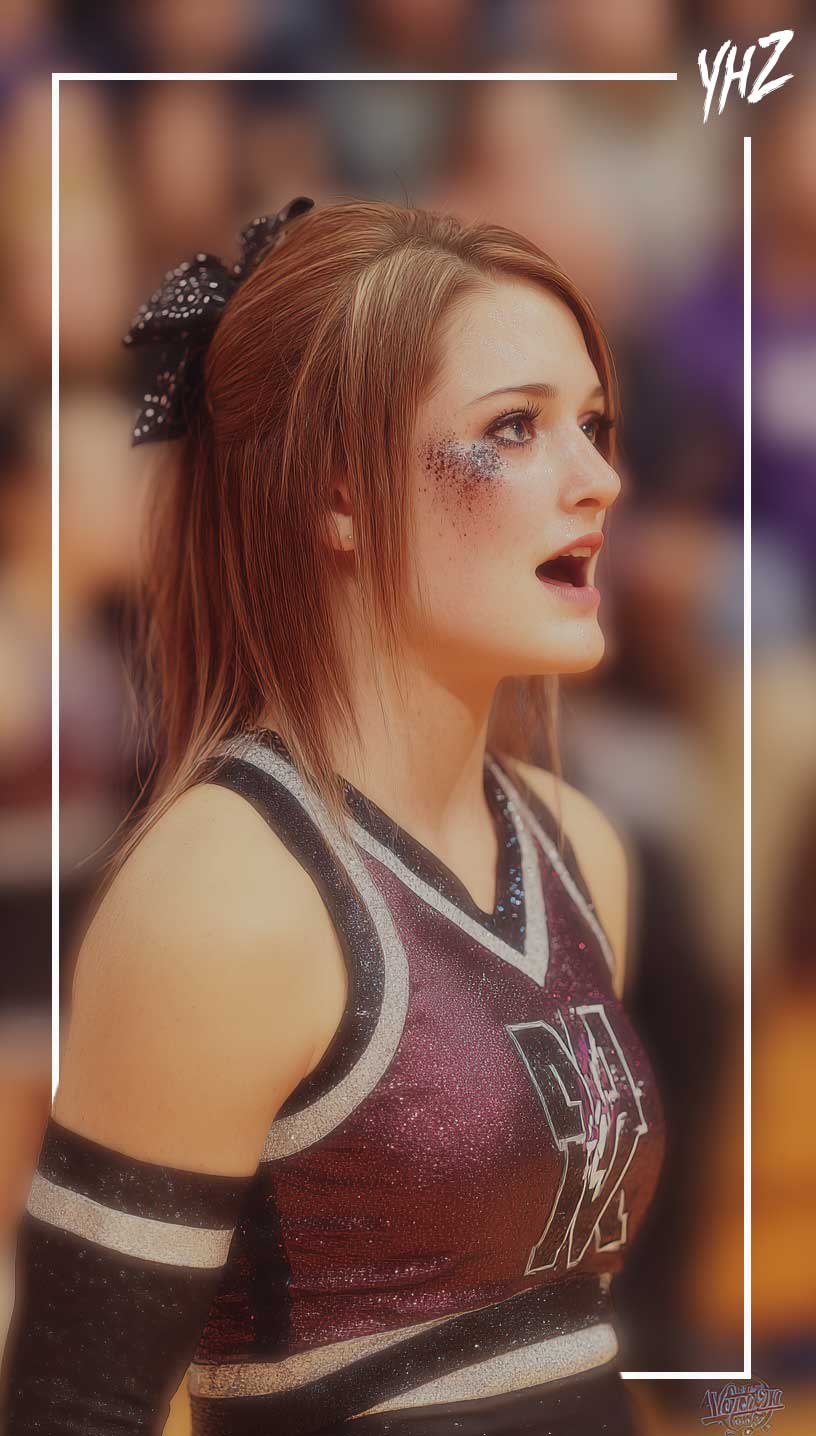

College cheerleading faces existential questions

The Pro League’s impact on college cheerleading remains uncertain but potentially transformative. With over 250 colleges offering programs but typical scholarships only $500-$1,000 annually, the financial incentive clearly favors professional opportunities for elite athletes.

College programs must evolve or risk irrelevance. The traditional model—where college cheerleading represents the pinnacle for most athletes—crumbles when professional salaries exceed scholarship values by 10-50x. Smart colleges will develop partnerships with professional teams, creating integrated pathways that benefit both institutions.

The implications extend beyond individual programs. If top athletes skip college for professional opportunities, the talent level in collegiate cheerleading drops dramatically. This could trigger a downward spiral: lower talent means less exciting competitions, reduced fan interest, and ultimately less funding. Alternatively, it might clarify college cheerleading’s role as developmental rather than elite performance.

For gym owners, this shift requires recalibrating athlete counseling and development. The conversation changes from “which college program?” to “college or professional track?” This complexity demands more sophisticated guidance and potentially different training approaches for athletes pursuing different paths.

International expansion creates new dynamics

While the Pro League launches as an American venture, international implications loom large. The International Cheer Union represents 119 member nations with 7.5 million participants globally. Olympic recognition in 2021 accelerated cheerleading’s international growth, creating a global talent pool previously disconnected from American elite pathways.

Bill Seely mentioned interest from Canadian and European athletes, but this understates the potential disruption. International athletes who previously had no professional prospects in cheerleading now see a clear target. Expect increased competition for professional spots as global talent seeks American opportunities.

For American gyms, this creates both challenges and opportunities. Competition for professional positions intensifies as international athletes enter the pool. But gyms that develop international recruitment pipelines and cultural support systems can tap into new markets. Consider how international students transformed American university economics—cheerleading could follow a similar pattern.

The regulatory complexities of international athlete participation remain unaddressed. Visa requirements, work authorization, and athlete rights create bureaucratic challenges Varsity must navigate. Gyms hoping to recruit internationally need legal expertise and administrative systems previously unnecessary in cheerleading.

Survival strategies for independent gyms

For the majority of gyms without professional partnerships, survival requires strategic adaptation rather than direct competition. You cannot outspend or outmuscle Varsity, but you can find profitable niches in the new ecosystem.

First, clarify your value proposition. If you’re not sending athletes to professional teams, what do you offer? Strong answers include: community connection, affordable excellence, diverse program offerings, or specialized training. The key is differentiation—you must offer something the professional pathway doesn’t provide.

Develop alternative competitive tracks that don’t depend on Varsity competitions. International competitions, collegiate preparation, and performance opportunities create athlete goals beyond the professional league. While Varsity dominates traditional all-star cheerleading, creative gyms can build successful programs around alternative objectives.

Financial diversification becomes critical. Gyms overly dependent on elite team tuition face severe risk. Expand into recreational programs, adult fitness, tumbling classes, and summer camps. These programs generate steady revenue less affected by professional league disruption. The most resilient gyms will derive no more than 40% of revenue from elite competitive teams.

Consider cooperative strategies with other independent gyms. Shared coaching resources, joint training camps, and collaborative competition teams help smaller gyms maintain competitiveness. While Varsity consolidates control vertically, independent gyms can create horizontal networks that provide mutual support.

The harsh reality of adaptation

The Varsity Pro Cheer League forces uncomfortable decisions on every gym owner and coach. You must choose: attempt to join Varsity’s professional ecosystem, compete independently, or pivot toward different market segments. Each path demands different strategies, investments, and acceptance of different risks.

For gyms with professional partnership ambitions, the requirements are clear but demanding. Facility upgrades alone could cost $500,000-$2 million to meet professional standards. Coaching salaries must increase to retain talent. Marketing and content creation require professional investment. These costs mount before considering the operational complexity of managing professional and amateur programs simultaneously.

Independent gyms face different but equally serious challenges. How do you maintain relevance when the sport’s pinnacle exists outside your reach? How do you motivate athletes when professional opportunities require leaving your program? How do you compete for talent when partner gyms offer professional pathways? These questions don’t have easy answers, but ignoring them guarantees failure.

The pivot toward recreational or alternative focuses might seem like retreat, but it could prove the smartest strategy. The youth sports participation market continues growing even as elite pathways consolidate. Parents increasingly seek healthy activities over hypercompetitive environments. Gyms that capture this market might find more sustainable success than those chasing professional partnerships.

Financial projections reveal sobering truths

Let’s examine realistic financial scenarios for different gym types as the professional league develops:

Scenario 1: Current Partner Gym

- Revenue increase: 25-40% within 3 years

- Required investment: $1-3 million in facilities and staff

- Risk factors: Dependence on Varsity decisions, athlete burnout, market saturation

- Probability of success: 70% given Varsity support

Scenario 2: Aspiring Partner Gym

- Revenue impact: -10% initially, potential +20% if selected

- Required investment: $500,000-$1 million in preparation

- Risk factors: May never receive partnership, opportunity cost of investment

- Probability of success: 30% given limited expansion slots

Scenario 3: Independent Elite Gym

- Revenue impact: -15-25% over 3 years

- Required investment: $100,000-$300,000 in program diversification

- Risk factors: Continued athlete drain, reduced competitiveness

- Probability of maintaining current scale: 40%

Scenario 4: Pivoting Recreational Gym

- Revenue impact: -20% initially, stabilizing at -5% within 2 years

- Required investment: $50,000-$150,000 in program development

- Risk factors: Brand perception, staff expertise gaps

- Probability of successful transition: 60%

These projections assume competent management and favorable local markets. Poorly managed transitions could result in -40-50% revenue declines or complete failure.

Time-sensitive decisions demand immediate action

The professional league launches in January 2026, but critical decisions cannot wait. Tryouts begin September 2025, meaning athlete recruitment and retention strategies need implementation now. Every month of delay represents lost opportunities and increased risk.

For gyms pursuing partnerships, begin relationship building immediately. Attend Varsity events, develop connections with current partner gyms, and demonstrate your value to the ecosystem. Waiting for Varsity to notice you is a losing strategy—proactive engagement improves your odds dramatically.

Independent gyms need even more urgent action. Diversification takes time, and cultural change happens slowly. If you’re pivoting toward recreational programs or alternative competitive tracks, begin that transition now. Your current elite athletes provide credibility for launching new programs—once they leave, building from scratch becomes much harder.

Financial preparation cannot be overstated. Whether pursuing partnership or independence, the next 24 months will strain resources. Secure credit lines, build cash reserves, and prepare for revenue volatility. Gyms entering this transition with weak balance sheets face extreme survival risk.

Disruption demands strategic response

The Varsity Pro Cheer League represents the most significant structural change in competitive cheerleading history. Whether you view it as opportunity or threat, ignoring it guarantees obsolescence. Every gym must develop a strategic response aligned with their capabilities, market position, and ownership goals.

For the chosen few partner gyms, the league offers unprecedented opportunities for growth, prestige, and financial success. These gyms will shape professional cheerleading’s future while building sustainable competitive advantages. Their challenge lies in managing complexity while maintaining program quality across amateur and professional tracks.

For aspiring partners, the path requires significant investment with uncertain returns. Success demands exceptional execution, strategic positioning, and some luck. The rewards for those who succeed could be transformative, but the majority will invest heavily without achieving partnership, making this a high-risk strategy.

Independent gyms face the hardest choices. Competing directly with Varsity’s professional ecosystem seems futile, but creative adaptation offers viable paths forward. Whether through international expansion, alternative competitive tracks, or recreational focus, successful independent gyms will find profitable niches Varsity doesn’t serve.

The uncomfortable truth is that competitive cheer’s landscape will look dramatically different in 5 years.

The professional league accelerates existing consolidation trends while creating new competitive dynamics. Gyms that acknowledge this reality and adapt strategically will survive and potentially thrive. If you resist the change or react slowly, you’ll likely face marginalization or closure.

Your response to the Varsity Pro Cheer League will likely determine your gym’s future. Choose wisely, act decisively, and remember that in times of industry disruption, strategic clarity matters more than resources. The gyms that emerge strongest won’t necessarily be the biggest or best-funded—they’ll be the ones that most clearly understand their value proposition in cheer’s new professional era.

IPP's Premade Mixes are USA Cheer Compliant and customizable! Add Sound FX, swap songs, & more! Add your Team Name to the mix for only $10!